I opened a bank account with Key Bank long ago when they offered a free iPod with each new account. I was maybe 13, 14? and pretty excited about the free iPod just for opening the account. $99 worth of free, and as a teenager, it was worth it all the way – and off I went to Key Bank to open my account there and get my first Credit Card.

I was pretty happy with the account over the years. Later on, however, things started to get a bit messy.

First, there was the method of avoiding the monthly fees. This required eight transactions per month to keep the account fee-free. So my banker helped me set up monthly auto-transfers, as they had been doing with most of their customers. So I had $10 going out and then back in my account, five times/month.

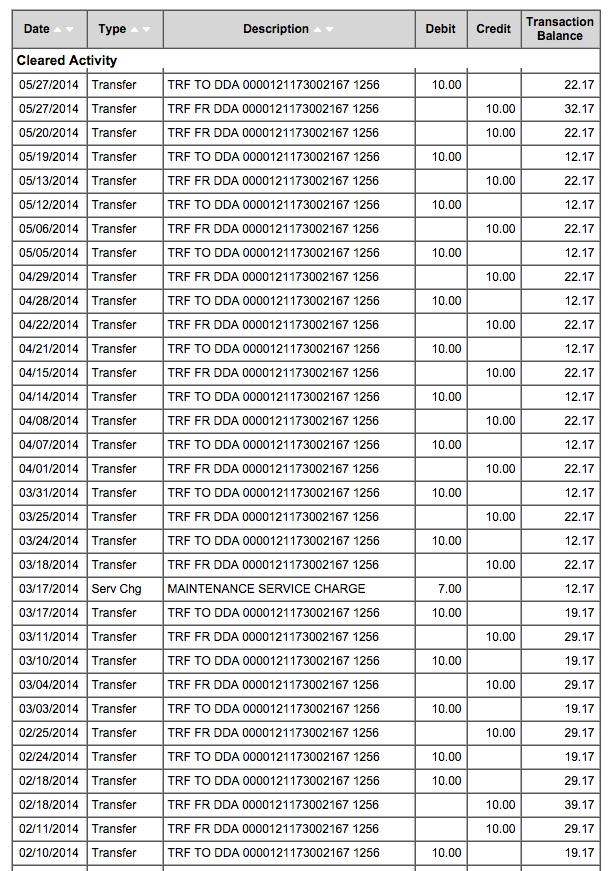

It was always a bit frustrating to sift through these transactions. When budgeting or looking over my account statements, there were eight additional transactions I had to look over each month. It felt a little silly that I had to transfer $10 in and out like that. After several years, I didn’t use my account much and this is what my statement began to look like:

It was a mess of transfers in and out.

Second, notice the $7.00 service fee on the 17th of March? That wasn’t supposed to happen. I called Key Bank to ask them about the charge and the customer support rep said:

“You have 9 transactions for this cycle, and you should not have been charged a maintenance fee.”

She tried to refund it, but since it was over three months ago, the system wouldn’t allow it. She apologized and recommend that I check my statement each month.

I felt so frustrated that I had to keep tabs on my bank to ensure they weren’t erroneously charging me fees.

I went into a local branch to see if they could help. The personal banker I spoke to said she couldn’t refund the fee. She verified that I had enough transactions in my account that month and should not have been charged that fee. She also only had access to refund fees three months back. She said she wasn’t sure who I should talk to, but possibly the branch where I opened the account. So I called the branch where I opened my account. They couldn’t help either.

Its not an issue of recovering an erroneously charged $7 maintenance fee. Its an issue of: “Can I trust my bank?”

To feel that I have to keep track of the actions they take is frustrating. At the time, I was billing at $75/hour. I spent several hours just researching whether or not these charges were correct – looking at my account, calling in, researching fees, etc. It wasn’t worth my time. Yet the principle of it bothered me.

Third, I got an auto loan with Key and everything went swimmingly. The personal banker I worked with was great. However, when it came time to sell the car, pay off the loan, and get the title, it was a bit of a mess. There was such a long delay in receiving the title on my car. I dealt with a frustrated buyer for almost 2 months. He received a fine. I spent hours on the phone with Key, trying to learn the status of my title and to get it sent to me. It was stuck in processing for months.

Then there was the fact that I wanted to consolidate my accounts. I had another account that I was using as my primary account and when these things happened with Key Bank, I just didn’t see a need to keep the accounts opened. I believe finances are meant to be simple. And having multiple accounts, especially accounts that I wasn’t using and wasn’t happy with, made things more complex. So I closed my accounts. My checking, savings, and line of credit.

There were many good things about Key Bank, and I’m grateful to the many bankers and tellers who were great at what they did. Key Bank helped me many times and I’ve been very thankful for those. But when I started to use my account less and less, the negatives were things I just felt I shouldn’t have to deal with. These weren’t huge things, I know, but I was confident there was a better way when it came to banking.

You may want to follow up on that closed account. Apparently Key Bank will continue to charge fees to the supposed closed account. They don’t send you any bill, and you fine months or years later that you owe money that has accrued. I’m not sure how they can get away with this, but they do.

I just got off the phone with Key, this was the second time I “closed my account” with them. If I get hit with the $50 annual fee for their rewards program, or if there needs to be a third time to close the account, I’m calling the family attorney to have her subpoena their phone records of me repeatedly closing this stupid account.

Keybank wont close my account. They paid a bill I was disputing. I called to freeze the payment and they wouldnt. Now I’m having to deal with a refund for some shady billing from a company, because my own bank wouldnt listen to me. I’m now being charged NSF fees constantly and the bank refusing to close the account. Now its bank fees and atm fees. How is this legal?

I was told no fees for one year, still well under a year, I have asked if I’ve gotten any fees, they’ve always said no, but sorting thru I see $18 service charge? And I suspect many more but no one will answer there phone, it says we will be right with you and rings for hours with noone ever answers.

I closed one of my Key accounts recently. I had bee using mobile check deposit and was very happy with it. They should have been happy too since it means they don’t have to staff the branch as heavily.

I had a flurry of deposits at one point and found that there was a weekly limit on the value of checks you could deposit. huh? I called Key and someone told me that because I dust have a Preferred account (or some other jargon) there was limit. At the time I had about $30,000 in accounts at Key. I pointed that out, no, my account wasn’t Preferred (or whatever). Sorry, nothing they could do. Later that day I opened an account with a primarily online bank that has a much higher limit, never has fees in accounts no mater how low the balance is, and refunds all my atm fees. And I closed that Key account.

They mishandled my funds repeatedly then got disrespectful smilung about missing funds then threatened me with police ..so done with the employees RASISM and purpose intent to ruin my account. Bills are all messed up due to there mishandled of my account!

Keybank closed my account because it was negative but I had direct deposit going in every 2 weeks when I got paid to that account to pay it down, as soon ans I got my automatic taxpayer refund form the state of Indiana to help with the inflation they closed my account. We were getting a second payment from Indiana in August of $200 well Nov 1 I called the department of revenue and they said the sent the money to that account on Aug 15 and it has been closed since May.. keybank accepted the deposit. The gentlemen I talked to in “Recovery” said that it was in keybanks fine print that closed accounts that are negative will still allow deposits to pay for negative balance. Then why didn’t a banker tell me this when I opened the account? I have never had a bank receive deposits In a closed account they always reject it and I get a check. I have received nothing from Keybank since May when they sent a letter saying they closed my account. Should I contact someone about them taking money into a closed account because the lady at the bank said the last deposit she could see was from like a month before this when I know I have had direct deposits of 50 going into that account and a deposit of $125 from the state of Indiana was the very last deposit.

they are awful. i went in to ask them what i could do if my account did not have enough money to maintain the no fees and she said that 8 transactions per month malarkey and i knew right there and then we would not be long for this world. i did close my account but they just sent me a debit card so will have to go and deal with their stupidity. cannot wait to see what the explanation for this is